Immigrating to Canada is a fresh start for our clients, and they are often concerned about how to legally and compliantly transfer their assets to Canada. We offer professional consultation services in this area, helping clients safely and legally transfer their assets, ensuring they can start their new life in Canada without any worries.

Our Services:

• Asset Transfer Plan Design:

Based on the client's financial situation and immigration goals, we tailor asset transfer plans. We conduct an in-depth analysis of tax regulations, foreign exchange policies, and legal requirements between China and Canada, designing the most suitable asset transfer plan to maximize tax benefits and ensure legal compliance.

• Financial Asset Transfers:

We assist clients in transferring financial assets from China, including bank deposits, stocks, funds, and insurance. We collaborate with multiple Canadian banks and financial institutions to provide secure and efficient channels for fund transfers, ensuring the client's funds arrive safely in Canada while complying with local legal requirements.

• Real Estate Asset Transfers:

For clients who own real estate in China, we assist with the sale, lease, or transfer of their property, and help them legally transfer the proceeds to Canada. Our services cover tax planning, fund transfers, and the preparation of legal documents, ensuring compliance and transparency throughout the process.

• Tax and Compliance Consultation:

Immigration asset transfers involve complex tax and compliance issues. We provide tax planning and compliance consultations to ensure that clients meet all legal requirements during the transfer process, avoiding unnecessary tax burdens. We also help clients understand Canada's tax environment and develop appropriate tax strategies.

Our Advantages:

• Extensive Professional Expertise: Our team consists of legal, financial, and tax experts from both China and Canada, with rich experience in cross-border asset transfers.

• Customized Services: We provide tailored asset transfer plans for each client, ensuring that our services meet their personal needs and financial goals.

• Security and Compliance: We strictly adhere to the legal regulations of both China and Canada, ensuring a legal, safe, and seamless asset transfer process.

• Full Support: From initial consultation to the final asset transfer, we offer full guidance and support to ensure that each step is completed smoothly.

Applicable Scenarios:

• Clients preparing to immigrate to Canada with significant assets in China

• Clients needing to transfer bank deposits, securities, real estate, or other assets from China

• Clients planning to transfer or restructure business assets from China to Canada

• High-net-worth clients interested in tax planning, wealth protection, and estate planning

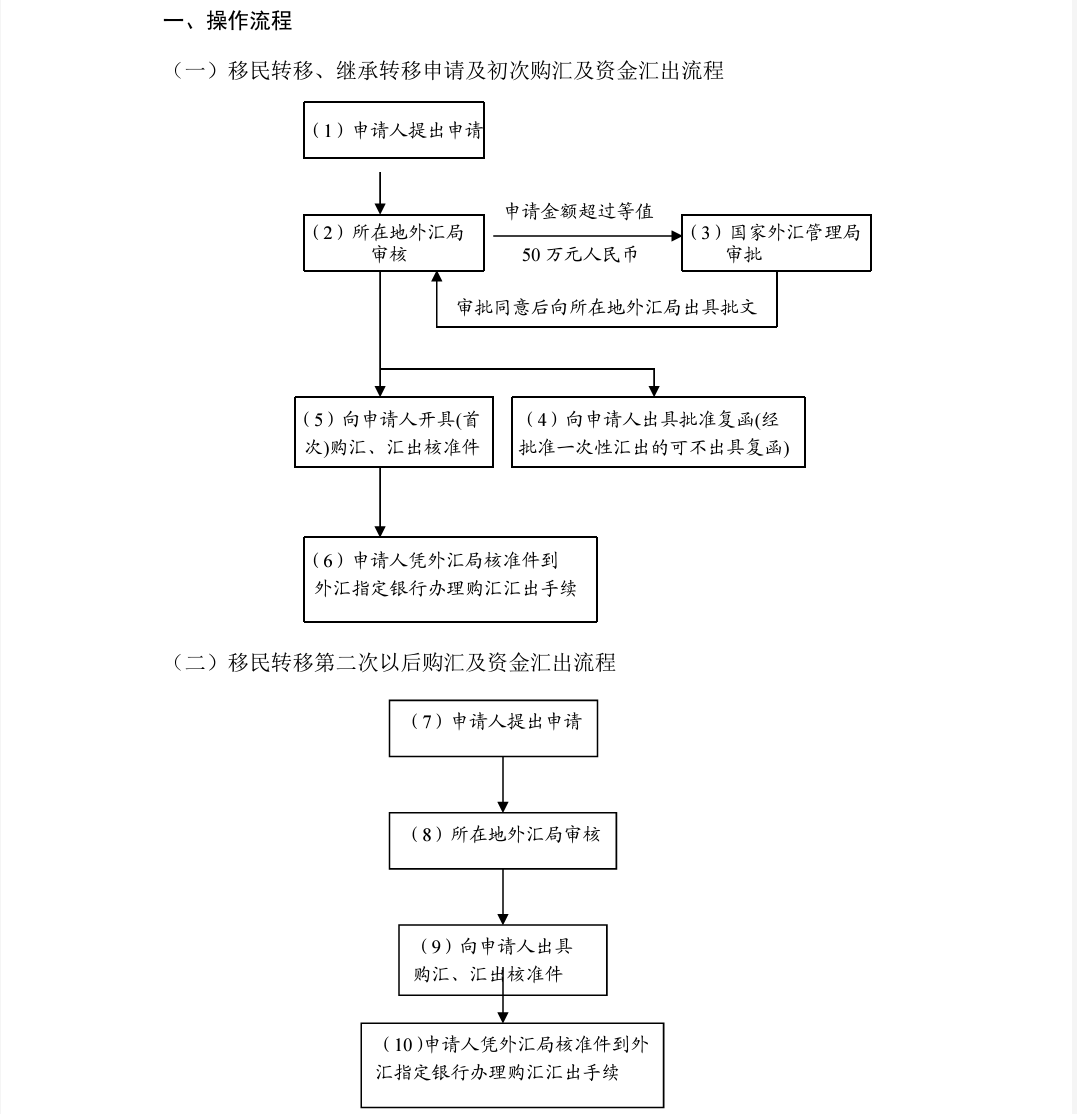

Service Process: